BUY AND SELL LAND

WITH JON JASNIAK

MY GOAL IS TO INCREASE YOUR NET WORTH AND CASH FLOW WITH LAND!

BUY AND SELL LAND

WITH JON JASNIAK

MY GOAL IS TO INCREASE YOUR NET WORTH AND CASH FLOW WITH LAND!

LAND GIVEAWAYS

Jon's Exclusive Content

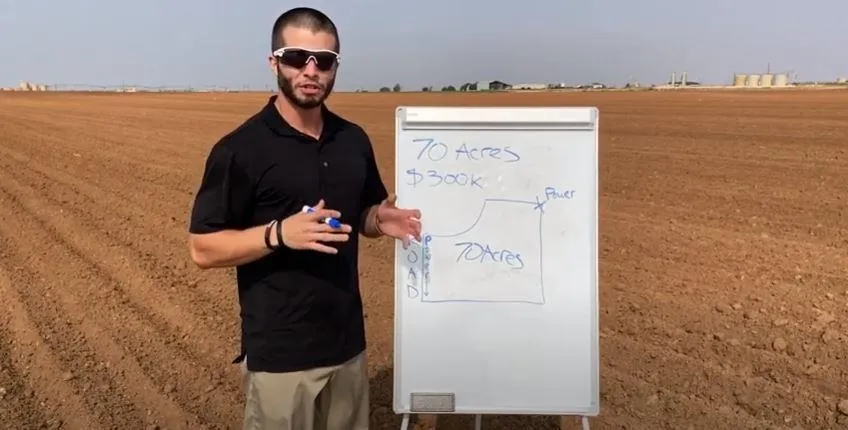

Land Subdividing Mastermind

Jon teaches his proven methods

Jon's Exclusive Content

BUY AND SELL LAND

ONLINE COURSE

Jon teaches his proven methods

PRESALE

POWERFUL BUY AND SELL LAND BOOKLET

Learn Jon’s Land Secrets

GROW NET WORTH

Through buying undervalued land

MAKE YOUR OWN HOURS

Work where and when you want

GROW NET WORTH

Through buying undervalued land

OWN YOUR FUTURE

With land assets that cash flow

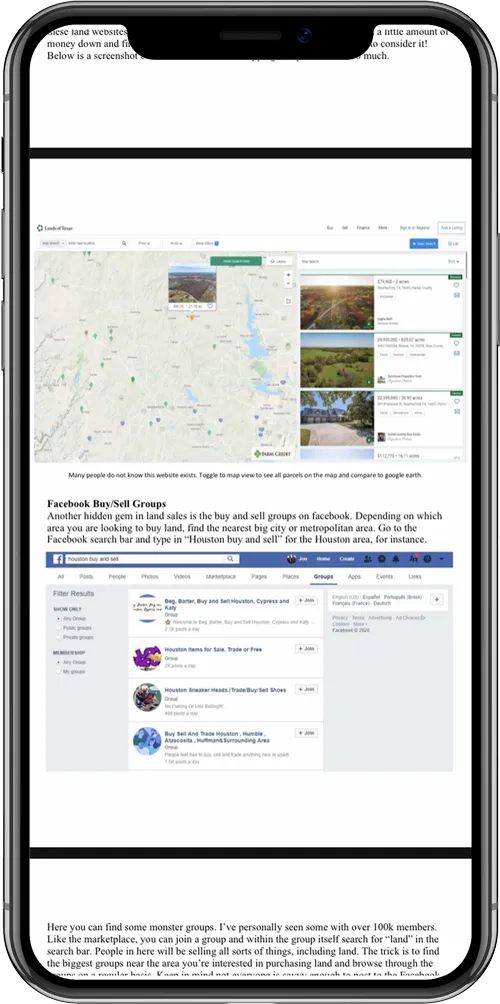

TOP FREE CONTENT

SUBSCRIBE NOW

AND STAY INFORMED

TOP FREE CONTENT